With the popularization of Matter protocol and the maturity of smart home ecology, the international smart home platform has formed a dual-track competitive pattern of commercial mainstream platforms and open-source self-built platforms. The core players include Apple HomeKit, Google Home, Amazon Alexa, Samsung SmartThings, and Home Assistant. This article conducts in-depth analysis from two core dimensions: market share and technical strength, clarifying the advantages, characteristics and applicable scenarios of each camp.

Ⅰ. Market Share Pattern: Commercial Platforms Dominate, Open-Source Platforms Grow Rapidly

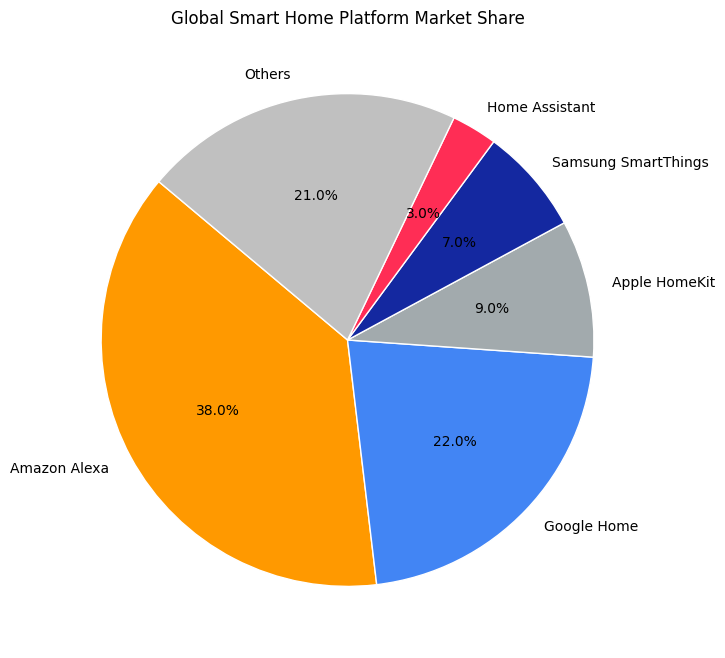

Data from authoritative institutions (IDC, Statista 2024) shows that the global smart home platform market presents a “commercial platform leading + open-source platform high-growth” pattern, with the top 5 platforms accounting for over 85% of the market share:

1. Top Tier: Amazon Alexa (≈38% Global Market Share) — Absolute Traffic Leader

- Core Position: It has maintained the first place in the global smart home platform market for 8 consecutive years, relying on the early layout of smart speakers to occupy the user entrance.

- Market Drivers:

∘ The shipment volume of supporting smart speakers (Echo series) ranks first in the world, with a penetration rate of over 40% in the North American market;

∘ It has the largest number of ecological devices (over 80,000 models), covering home appliances, security, lighting and other full scenarios;

∘ Strong channel advantages in North America, Europe and Southeast Asia, and in-depth cooperation with local home appliance brands.

- Weakness: The ecological closure is relatively low, and the consistency of device experience is uneven.

2. Second Tier: Google Home (≈22% Global Market Share) — Strong Ecological Compatibility

- Core Position: The second largest market share, relying on Google’s Android system and search ecology to quickly seize users.

- Market Drivers:

∘ Deeply bound to Android smartphones (over 2 billion global shipments), users can quickly access through mobile phones;

∘ Early support for Matter protocol, compatible with most third-party smart devices, and the number of ecological devices exceeds 60,000;

∘ Strong AI voice interaction capabilities, relying on Google Search to provide more accurate scene-based services.

- Weakness: The shipment volume of self-developed hardware (Google Nest series) is lower than that of Amazon, and the user stickiness in the Asian market is weak.

3. Mid-Tier Commercial Camp: Apple HomeKit (≈9% Global Market Share) — High-End User Core

- Core Position: Focus on the high-end market, relying on the Apple ecological closed loop to achieve high user loyalty.

- Market Drivers:

∘ Seamless linkage with Apple devices (iPhone, iPad, Apple Watch, HomePod), forming a “full-device interconnection” experience;

∘ Strict device access certification, high product quality and security, and favored by high-income users (the average user ARPU is 3 times that of Alexa);

∘ The penetration rate in the European and North American high-end markets exceeds 15%, and the growth rate of supporting devices (such as smart door locks, home security) is over 30%.

- Weakness: High access threshold for third-party brands, small number of ecological devices (about 30,000 models), and high hardware costs.

4. Mid-Tier Commercial Camp: Samsung SmartThings (≈7% Global Market Share) — Hardware Ecological King

- Core Position: Relying on Samsung’s full-category home appliance layout, it has obvious advantages in the integrated smart home scene.

- Market Drivers:

∘ Bundled with Samsung home appliances (TVs, refrigerators, air conditioners, washing machines), with a shipment volume of over 200 million sets of supporting home appliances annually;

∘ Strong compatibility, supporting Matter, ZigBee, Z-Wave and other multiple protocols, and the ecological device coverage is close to 50,000 models;

∘ Leading in the European and Korean markets, the market share in the integrated home scene exceeds 18%.

- Weakness: The voice interaction capability is weaker than Alexa and Google Home, and the user activity in the non-Samsung hardware ecosystem is low.

5. Leading Open-Source Camp: Home Assistant (≈3% Global Market Share) — Self-Built Scenario Leader

- Core Position: The world’s largest open-source smart home platform, favored by technology enthusiasts and small and medium-sized enterprises, with a year-on-year growth rate of over 45% (the fastest among top platforms).

- Market Drivers:

∘ Fully open-source and free, supporting self-deployment (local server/Cloud), no dependence on third-party commercial platforms, and high data privacy;

∘ Super strong compatibility, supporting over 1,500+ device brands and 50+ communication protocols (Matter, Wi-Fi, Bluetooth, ZigBee, Z-Wave, etc.), realizing “unified management of mixed-brand devices”;

∘ High customization, users can freely develop plug-ins, customize scene linkage logic, and meet personalized needs (such as linkage between industrial sensors and home devices);

∘ Active community, with over 10 million global users and 20,000+ community-developed plug-ins, fast problem-solving and function iteration.

- Weakness: High deployment and maintenance thresholds, requiring basic technical capabilities (such as Linux operation, server configuration); no official self-developed hardware, relying on third-party hardware adaptation.

Ⅱ. Technical Strength Comparison: Commercial Platforms Focus on Experience, Open-Source Platforms Win by Customization

1. Core Protocol Support: Matter Unifies the Bottom Layer, Differentiation in Extended Capabilities

- Key Conclusion: All 5 platforms have completed full support for the Matter protocol, realizing “one device access, multi-platform interconnection”. Home Assistant leads in protocol coverage (supports industrial-grade protocols such as Modbus), while Google Home/Apple HomeKit are stronger in Thread low-power networking, and SmartThings excels in home appliance hardware linkage.

2. AI Voice Interaction: Commercial Platforms Lead, Home Assistant Relies on Third-Party Integration

- Amazon Alexa: The most mature voice interaction capability, supporting over 100,000 voice skills, high accuracy in daily scene recognition, and supporting multi-language/dialect recognition.

- Google Home: Strong contextual understanding and logical reasoning, supporting complex voice commands, closely linked to Google Search for real-time information services.

- Apple HomeKit: Integrated with Siri, focusing on privacy protection, fast response speed (delay < 0.5s), but fewer voice skills (focused on home control).

- Samsung SmartThings: Integrated with Bixby, mainly oriented to Samsung hardware control, weak compatibility with third-party device control.

- Home Assistant: No official built-in voice assistant, supports integration with Alexa, Google Assistant, Siri, and open-source voice assistants (such as Rhasspy); voice interaction logic can be fully customized, but requires manual configuration, with higher thresholds.

3. Security Performance: Apple Leads in Privacy, Home Assistant Controls Data Autonomy

- Apple HomeKit: Highest security level, end-to-end encryption (E2EE) for all data, strict MFi certification for device access, zero data leakage risks.

- Google Home: Relying on Google Cloud Security, providing device authentication and data encryption, supporting family permission management.

- Amazon Alexa: Multi-level permission management and data encryption, but low ecological access threshold leads to potential third-party device security risks.

- Samsung SmartThings: Focus on hardware security, integrate security chips in self-developed home appliances, and monitor device operation status in real time.

- Home Assistant: Local deployment supports “offline operation”, data is stored locally without cloud upload, maximum data privacy; but security depends on user’s server configuration (such as firewall setting), with higher user autonomy.

4. Ecological Openness & Customization: Home Assistant Is Fully Open, Commercial Platforms Balance Openness and Experience

III. Core Product Protocol Compatibility Highlight: AmpVortex Full-Series Models

In the smart home hardware ecological layout, AmpVortex has achieved full-protocol coverage across its product line, ensuring seamless access and stable linkage with all the above mainstream smart home platforms. Its four core product models — AmpVortex-16060, AmpVortex-16060A, AmpVortex-16060G, and AmpVortex-16100 — all natively support the core Matter protocol, as well as mainstream Wi-Fi and Bluetooth communication technologies. This all-protocol compatibility capability allows the four AmpVortex models to break through platform barriers, flexibly adapt to Apple HomeKit’s high-end ecological closed loop, Google Home’s Android ecological linkage, Amazon Alexa’s full-scenario device access, Samsung SmartThings’ home appliance integration, and Home Assistant’s open-source customized scenarios. Whether for home users pursuing multi-platform interoperability or enterprise users needing integrated smart scene deployment, AmpVortex’s full-series products can meet diverse access needs, realizing “one hardware, full-platform adaptation” and reducing the cost of device replacement and ecological migration.

IV. Core Competitiveness Summary & Applicable Scenarios

1. Amazon Alexa — Cost-Effective, Full-Scenario Coverage

- Core Competitiveness: Largest market share, richest ecological devices, mature voice interaction, low cost.

- Recommended Users: Users pursuing cost-effectiveness, needing multi-brand device access, and focusing on North American/European markets.

2. Google Home — Android Ecosystem, Intelligent Interaction

- Core Competitiveness: Deep Android integration, strong AI contextual understanding, stable Matter/Thread networking.

- Recommended Users: Android smartphone users, those paying attention to intelligent scene interaction, and needing stable multi-device linkage.

3. Apple HomeKit — High-End Quality, Extreme Privacy

- Core Competitiveness: Apple ecological closed loop, high security, seamless device linkage, high-end positioning.

- Recommended Users: Apple full-device users, high-income groups pursuing quality, and users focusing on data privacy.

4. Samsung SmartThings — Integrated Home Appliances, Multi-Protocol Interconnection

- Core Competitiveness: Samsung home appliance bundling, full-category hardware coverage, strong multi-protocol compatibility.

- Recommended Users: Samsung home appliance users, those building integrated smart homes, and users with existing ZigBee/Z-Wave devices.

5. Home Assistant — Full Customization, Data Autonomy

- Core Competitiveness: Fully open-source free, comprehensive protocol coverage, ultra-high customization, local data storage.

- Recommended Users: Technology enthusiasts, small and medium-sized enterprises (custom scene development), users needing industrial/home device linkage, and those focusing on data autonomy.

Ⅴ. Future Trend: Matter Unifies the Bottom Layer, Dual Tracks Coexist

- Protocol Convergence: Matter will become the global unified underlying protocol, and the compatibility gap between platforms will narrow;

- Dual-Track Development: Commercial platforms will focus on “hardware + software + service integration” (e.g., HomePod + HomeKit + Health), while open-source platforms will expand in industrial/home integration scenarios;

- AI Scenario Upgrade: Competition shifts from “device connection” to “active intelligent services” (e.g., user habit prediction, cross-scene active linkage);

- Privacy Competition: Local deployment (Home Assistant) and end-to-end encryption (HomeKit) will become key competitive points for user acquisition.