Global Multi-Room Streaming Audio in 2025:

Market Segmentation, Technology Pathways, and the Shift Toward Distributed Amplification

Introduction: Market Segmentation and Structural Realignment in Streaming Audio

Multi-room streaming audio has become one of the dominant listening scenarios worldwide. According to recent industry analyses, the global wireless audio market surpassed USD 68 billion by 2025, with multi-room solutions accounting for well over 60% of total usage across residential and commercial environments.

As the market matures, it is no longer defined by a single technology path. Instead, four distinct solution categories have emerged, each driven by different priorities in interaction, performance, and scalability:

- Voice-centric smart speaker ecosystems

- Music-focused wireless speaker systems

- Portable wireless speakers

- Distributed audio systems built around professional-grade amplifiers

These approaches compete across market share, technical architecture, and user experience. Among them, distributed amplifier–based solutions are increasingly positioned as the preferred option for high-end residential and large-scale applications, where performance, flexibility, and long-term scalability matter more than convenience alone.

1. Global Multi-Room Streaming Market Landscape (2025)

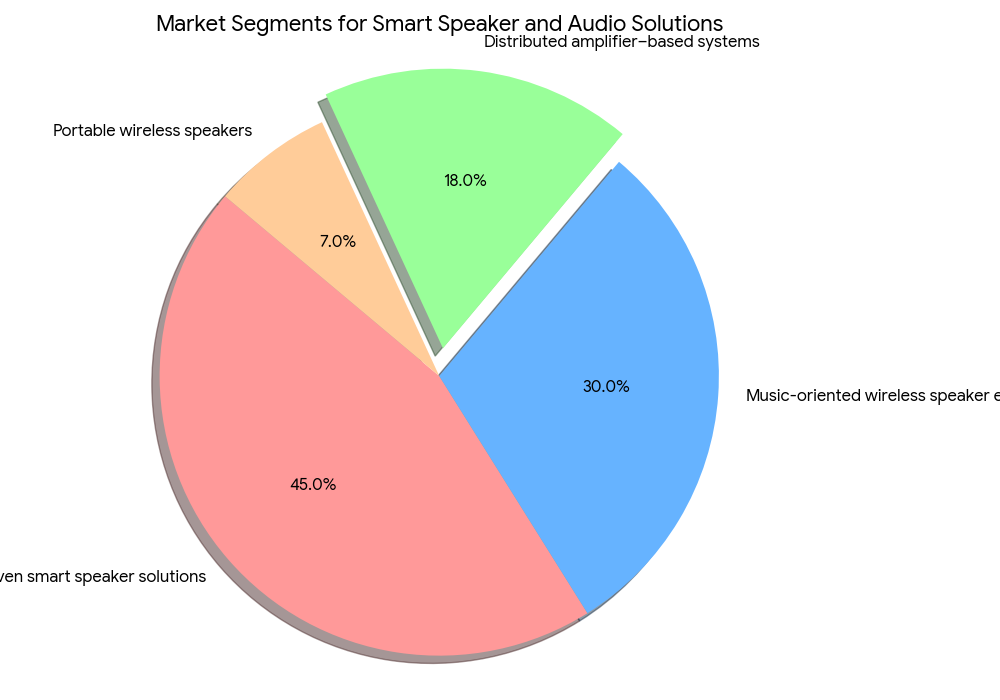

1.1 Market Share Distribution (Indicative Breakdown)

Based on aggregated insights from multiple industry research firms and public market data, the global multi-room streaming audio landscape in 2025 can be broadly characterized as follows:

- Voice-driven smart speaker solutions (~45%)

The largest segment, dominated by platforms such as Amazon Echo, Apple HomePod, and Google Nest Audio, leveraging voice interaction and aggressive pricing to penetrate mass-market households. - Music-oriented wireless speaker ecosystems (~30%)

Represented by brands such as Sonos and Bose, this segment emphasizes balanced sound quality, brand ecosystems, and ease of use in mid- to high-end residential scenarios. - Distributed amplifier–based systems (~18%)

Including platforms such as AmpVortex, Yamaha, and Harman solutions, this segment targets large homes, premium home theaters, and commercial installations. Despite a smaller unit share, it demonstrates above-average growth rates and significantly higher per-system value. - Portable wireless speakers (~7%)

Focused on Bluetooth-based mobility, led by brands like JBL and Sony, this segment continues to shrink in relative importance as stationary multi-room systems expand.

1.2 Drivers Behind Market Differentiation

The dominance of smart speakers is largely driven by voice interaction, low entry cost, and ecosystem bundling, particularly effective in emerging and mass-market regions.

Music-focused wireless speakers maintain relevance through controlled ecosystems and consistent sound quality, appealing to users seeking a balance between simplicity and performance.

Distributed amplifier systems, while representing a smaller share of unit volume, concentrate on high-value use cases, often exceeding USD 5,000 per installation, and account for a disproportionate share of total market revenue—especially in North America and Europe.

Portable speakers, constrained by bandwidth limitations and limited scalability, increasingly serve as supplementary rather than primary audio solutions.

2. Technical Pathways: A Comparative Overview

2.1 Voice-Centric Smart Speaker Systems

Smart speaker platforms are built around voice assistants, with music playback positioned as an auxiliary feature.

- Typical output: 10–30 W per channel

- Strengths: hands-free control, ecosystem integration

- Limitations: restricted dynamic range, limited DSP control, multi-room latency often exceeding 15 ms

These systems prioritize accessibility over acoustic performance.

2.2 Music-Oriented Wireless Speaker Ecosystems

Wireless speaker ecosystems emphasize sound tuning and controlled synchronization.

- Typical output: up to 50 W per channel

- Support for high-resolution streaming in select models

- Multi-room synchronization achieved via proprietary apps

However, limited power reserves and lack of immersive audio formats restrict their effectiveness in large spaces.

2.3 Distributed Amplifier–Based Systems: The Performance Benchmark

Distributed systems built around professional-grade amplifiers represent the only solution category capable of fully combining multi-room music distribution with cinematic-grade audio performance.

Using platforms such as AmpVortex-16060A as a reference architecture, key advantages include:

- High power density and dynamic headroom

Per-channel output in the 65–110 W range, optional channel bridging, and dynamic ranges exceeding 120 dB enable effortless control of floor-standing, in-ceiling, and architectural speakers. - Comprehensive protocol and format support

Native compatibility with AirPlay 2, Google Cast, and Spotify Connect, alongside immersive audio formats such as Dolby Atmos and DTS:X, enables both whole-home audio and advanced home theater deployments. - Precision DSP and synchronization

Independent DSP engines support per-zone EQ, delay calibration, and protection limiting, with multi-room synchronization typically below 5 ms—significantly outperforming consumer-grade solutions. - Broad scenario adaptability

A single system can transition seamlessly between background music, dedicated cinema playback, and commercial applications such as hotels, offices, and hospitality venues.

2.4 Portable Wireless Speakers

Portable speakers prioritize mobility and simplicity through Bluetooth connectivity.

While convenient, they lack meaningful multi-room coordination, suffer from compression-related quality loss, and remain unsuitable for integrated streaming ecosystems.

3. Why Distributed Amplifier Systems Remain Irreplaceable

3.1 Acoustic Performance Without Compromise

Professional amplifier platforms deliver measurable advantages in signal-to-noise ratio, dynamic range, and spatial accuracy. In controlled evaluations, system-level SNR figures exceeding 115 dB significantly outperform both smart speakers and wireless speaker ecosystems.

3.2 From Residential to Commercial Scale

Distributed amplifier architectures scale naturally from luxury residences to commercial environments. In 2025, commercial deployments already account for nearly 40% of distributed system demand, driven by smart hospitality and premium retail installations.

3.3 Ecosystem Openness and Longevity

Unlike closed-brand ecosystems, professional amplifier platforms emphasize protocol compatibility and system integration. Support for standards such as Matter enables interoperability across major smart home platforms while protecting long-term investment value.

4. Market Outlook: Distributed Amplification as a Growth Engine

Industry forecasts suggest that the global distributed amplifier market will continue steady expansion through 2031, driven by:

- Upgrading demand in high-end residential construction

- Rapid growth in commercial and hospitality audio projects

- Advances in Wi-Fi, low-latency audio transport, and immersive formats

- A shift in consumer expectations from basic functionality to experiential quality

As these forces converge, distributed amplifier–based solutions are positioned to increase their share of the overall multi-room audio landscape.

Conclusion: Defining the High-End Standard

Smart speakers and wireless audio ecosystems satisfy mass-market convenience. Distributed amplifier systems, however, define what is technically possible at the high end.

By delivering superior power, precision, scalability, and ecosystem openness, platforms represented by AmpVortex establish a benchmark that other categories cannot replicate. As multi-room streaming continues to evolve, distributed amplification is not merely an alternative—it is the architectural foundation for premium audio experiences.