At approximately 8:00 PM Beijing time on December 5th, cross-border streaming giant Netflix (unofficial translation: “NetFlix”) announced the acquisition of roughly half of Warner Bros. Discovery’s (WBD) assets for $82.7 billion (equity value of $72 billion).

Acquisition primarily covers the film and television division, including HBO Max, the HBO streaming platform, and the century-old film studio structure. Simultaneously, assets such as the Mortal Kombat game series, Hogwarts Legacy, the Batman: Arkham series, the Lego games series, and Gotham Knights, along with their studios, will be fully integrated.

According to the press release, Netflix will maintain Warner Bros.’ current operations. Warner Bros.’ rich film and television resources and Netflix’s “leading streaming service” are expected to complement each other.

Is this Qin Shi Huang annexing the Six States? Is this Mixue Ice Cream & Tea acquiring Starbucks? A 27-year-old beating up a 101-year-old man?

There are all sorts of analogies being used. Let’s go through the following seven questions in one go, and you might gain a comprehensive and complete understanding of the whole affair.

1. Will the Golden Brand of HBO be Retained?

Will the streaming platform Max shut down, or will the two apps coexist?

Netflix stated that Warner Bros.’ existing operations will be preserved. The chance of discarding HBO’s “snow screen” title sequence in favor of Netflix’s “Tadum” sound is slim. However, this acquisition will likely mean that HBO Max no longer exists as an independent product.

The Max platform, formed by the merger of HBO Max and Discovery+, lacks the Midas touch needed for competitiveness; despite having 110 million subscribers, its revenue is still declining year-over-year. It is widely believed that retaining the Max service holds little value, especially considering its own history of “slashing.”

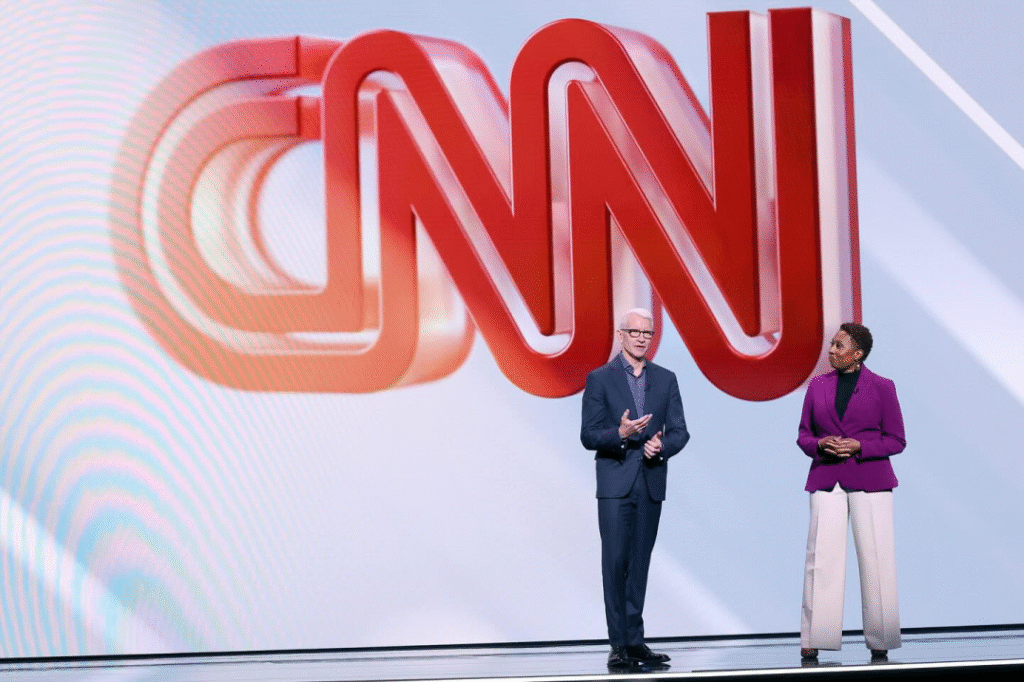

When merging with Discovery, WBD concurrently folded most of its Discovery+ content into Max, although users could still subscribe to the former independently. In contrast, CNN’s fleeting premium streaming service, CNN+, survived only a month before failing, and it is currently attempting a comeback as the sub-brand CNN Max. (Why are they so fond of the plus sign?)

Netflix’s pain point is the sheer volume of content, which can be overwhelming. HBO’s classic library could provide the long-tail retention capability that Netflix desperately needs. To avoid destroying the HBO brand, industry consensus predicts that Netflix will establish a dedicated HBO branded hub within its app, maintaining its curated, elite feel, similar to the “FX on Hulu” model.

The Hollywood Reporter predicts there will be a painful adjustment period involving the “collision of algorithms and curation.” Netflix’s user interaction design logic is to passively feed users, emphasizing algorithm-pushed, fast-consumption content and continuous auto-playback, whereas HBO content often requires immersive viewing and cultural incubation.

While Ted Sarandos has promised to maintain Warner’s existing operations, it is widely believed that HBO’s development team will face immense “cost reduction and efficiency increase” pressure. Those mid-budget, critically acclaimed but less popular prestige dramas may be the biggest victims. HBO’s proud creator-driven model might be challenged by Netflix’s data-algorithm-driven approach.

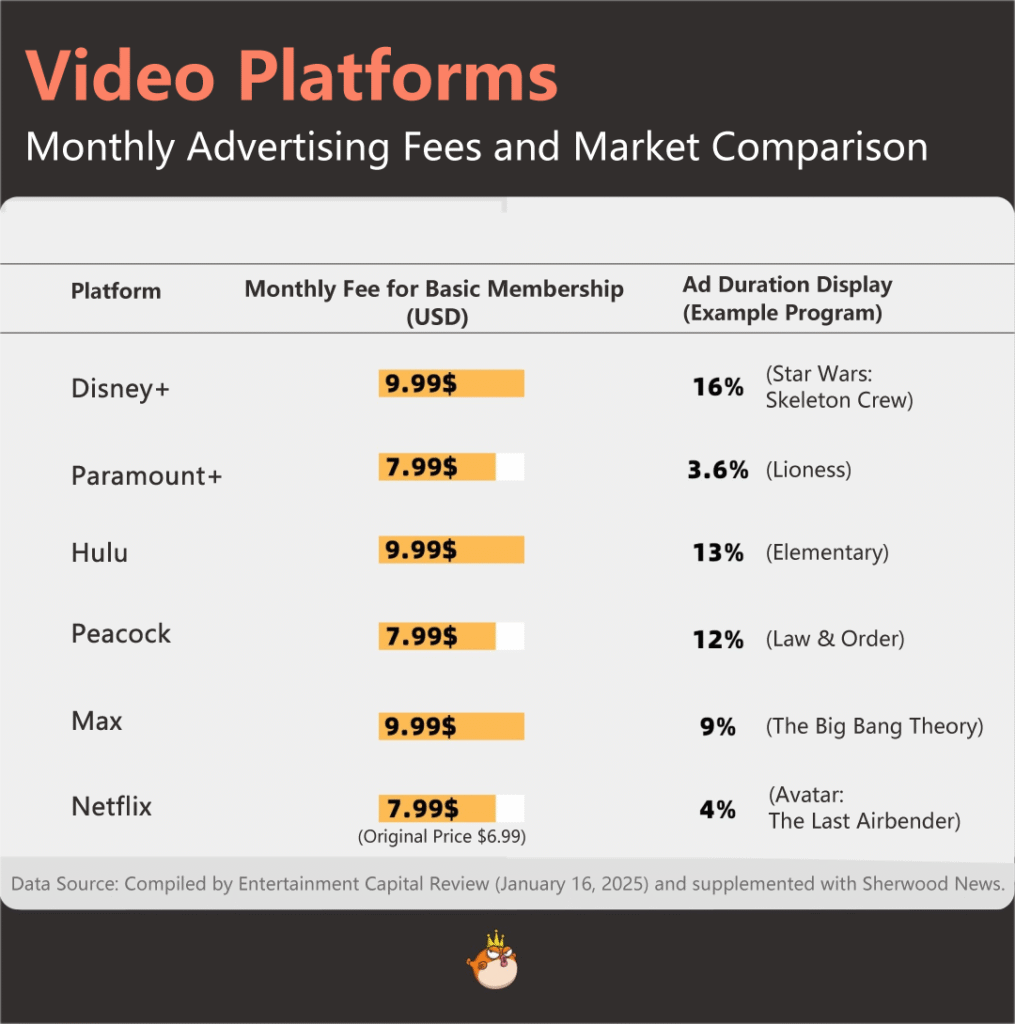

In summary, although we assessed Netflix’s membership as excellent value for money earlier this year, a price increase now seems inevitable.

2. Can the DC Film Universe Be Saved?

After Netflix takes over, can it elevate the quality of Superman and Batman films to rival Marvel, or will it completely scrap the existing universe?

The DC Universe is generally considered to have major problems, the largest being a lack of unified aesthetic and narrative logic, preventing audiences from establishing an emotional connection: from Zack Snyder’s serious mythological style to Joss Whedon’s forced humor, and then to subsequent standalone films like Joker, the universe has repeatedly wavered between “catching up with Marvel” and “maintaining its dark tone.”

Critics often describe Warner executives as “headless flies.” Some media outlets have argued that DC’s most captivating moments occurred when directors had absolute control, such as Nolan’s The Dark Knight or Phillips’ Joker. Conversely, attempts to build a “universe” were often sabotaged by clumsy executive editing and reshoots, as seen in the 2017 Justice League.

Additionally, domestic Chinese movie fans often criticize later DC films for severe “light pollution” in their special effects, and for sacrificing individual film quality to set up the larger universe, leading to the cart-before-the-horse situation of “making films just for the post-credits scenes.”

The biggest variable following Netflix’s acquisition is whether Ted Sarandos and his team will interfere with the creative process as frequently as the former Warner executives did. James Gunn’s ongoing plan, “Chapter One: Gods and Monsters” (including the 2025 Superman film), was initially the core of Warner’s revival. Whether this plan will be retained remains the biggest suspense.

Audiences are also concerned that Netflix might influence the future theatrical distribution of these works, which we will discuss shortly.

Although the fan fantasy of Disney buying DC to pit them against Marvel did not materialize, we can still hope for something else. Through the development of Arcane, Cyberpunk: Edgerunners, and The Witcher: Nightmare of the Wolf, Netflix has proven it possesses top-tier resources for adult animation production. Imagine developing Batman or Constantine animated series with the production quality of Arcane?

Furthermore, cross-media linkage with gaming studios, global market localization of derivative dramas, and overall IP development are all worth anticipating.

3. Will New Harry Potterand Lord of the RingsSeries Still Be Made?

Will these mega-IPs be shelved or accelerated due to the change in ownership?

The Harry Potter and Lord of the Rings IPs will not only be preserved but are the core reason for the massive acquisition; their development speed is expected to accelerate significantly, becoming the “moats” of the new empire.

Following the box office and critical failure of Fantastic Beasts: The Secrets of Dumbledore in 2022, which effectively shelved subsequent films in the Fantastic Beasts series, the game Hogwarts Legacy (released in 2023) sold over 30 million copies, becoming a lifesaver.

Meanwhile, original author J.K. Rowling’s complete break with the creators of the original films makes the fan-anticipated return of the original cast for a film adaptation of Harry Potter and the Cursed Child nearly impossible. Warner had previously officially announced that the seven original Harry Potter books would be remade into a long-form HBO series, a project planned to span 10 years.

Netflix urgently needs to fill the void left by the conclusion of Stranger Things, so the production of the new Harry Potter series may be accelerated. As mentioned earlier, they are also keen on the idea of cross-media linkage with games. Furthermore, it is not ruled out that Netflix may try to contractually limit Rowling’s social media speech rights to protect the drama’s marketing and promotion.

The Lord of the Rings series has long suffered from rights fragmentation. Amazon owns the adaptation rights to the Appendices and the Second Age of Middle-earth, having launched the most expensive series ever, The Rings of Power. While the show received mixed reviews, the second season was released in 2024, and production continues. Warner Bros. and its subsidiary New Line Cinema still hold the film adaptation rights to The Hobbit and the original Lord of the Rings trilogy.

In 2024, Warner released the animated film The War of the Rohirrim. Subsequently, they brought back the “Middle-earth creator” Peter Jackson as a producer and tapped Andy Serkis (who played Gollum) to direct the new live-action film The Lord of the Rings: The Hunt for Gollum, set for release in late 2027.

For fans, the good news may be that they might only need to subscribe to Netflix and Amazon Prime Video to watch all the Middle-earth stories, rather than the lackluster Max.

4. Can Theatrical Films Still Be Seen in Cinemas?

Warner is Hollywood’s most staunch supporter of theatrical releases. Will directors like Nolan still be willing to partner with Warner after the acquisition?

Although Netflix has clearly stated it will retain Warner Bros.’ existing theatrical distribution strategy, Hollywood authoritative media interpret this as merely a transitional promise aimed at appeasing Hollywood guilds and top-tier directors.

Netflix has long been the biggest enemy of the theatrical window. Founder Reed Hastings has repeatedly stated publicly that cinemas are not sacred temples but merely “dark rooms with better sound and popcorn.” Netflix has consistently insisted that films should be released simultaneously in theaters and on streaming, or maintain only a minimal, technical window (e.g., one week).

Due to Oscar rules requiring a theatrical run, Netflix previously released films like The Irishman or Roma in limited theatrical releases primarily to qualify for awards and as high-profile advertising.

Historically, Warner Bros. was Hollywood’s biggest champion of theatrical releases, known as “The Filmmaker’s Studio,” possessing a century-long genetic commitment to cinema, often maintaining exclusive theatrical windows lasting 75 to 90 days.

However, during the pandemic, then-WarnerMedia CEO Jason Kilar announced that all 2021 films, including Dune and Godzilla vs. Kong, would be released simultaneously in theaters and on HBO Max. This directly led to Christopher Nolan’s break with Warner, prompting him to move to Universal Pictures for Oppenheimer. His successor, David Zaslav, spent three years trying to repair relations with theaters, re-committing to “cinema-first” to barely win back some directors’ trust.

It is somewhat ironic that Netflix and the current Warner regime likely have few contradictions regarding the “streaming-first” model. Top-tier productions originally reserved for theaters will now serve streaming subscriptions more directly, and the theatrical window may be further shortened or become more flexible.

Currently, Sony and Universal Pictures are the only remaining major traditional studios in Hollywood without streaming baggage, fighting to defend the “big screen experience.” To prevent these iconic figures who champion theatrical experience from switching studios, Oscar contenders, blockbusters, or major director projects will be handled as special cases with long theatrical windows. Meanwhile, R-rated comedies, mid-budget dramas, and romance films that Warner excelled at in the past, like The Intern, may disappear from cinemas altogether.

5. What will Happen to CNN?

Netflix is not interested in the cable television business. What will happen to weak competitors like CNN and Discovery Channel?

According to the plan announced by Warner Bros. Discovery, the group will still be split into two independent publicly traded companies in the third quarter of 2026 as originally scheduled: one being the Warner Bros. business unit, and the other being Discovery Global, which will contain CNN and its other cable television networks. After the split, Netflix intends to acquire half the assets of the Warner Bros. unit, while Discovery Global will continue to operate under its existing structure.

Image Source: WBD official Instagram

Bloomberg reports that Wall Street is generally bullish on the divestiture of Warner’s linear television assets, viewing it as the final answer to resolving its debt crisis. As for what happens to the discarded assets… that remains uncertain. Whether they transform into pure digital media, face massive layoffs, or change hands again, no one knows what good solutions are left to save them.

6. What Are the Implications for Chinese Audiences?

Warner’s films were often imported into mainland Chinese cinemas. Since the new owner is a non-China-based company (Netflix), will we still see these blockbusters in theaters?

The short answer is: you will most likely still see Batman and Harry Potter in cinemas, but this must be facilitated through Warner Bros. acting as a “white glove” entity.

As early as 2017, Netflix attempted to introduce dramas like Black Mirror and Stranger Things into China through a content licensing deal with iQiyi. However, this was merely a simple sale of intellectual property rights, not a service launch. The partnership was not renewed after expiring in 2019. Hastings subsequently publicly admitted, “We have to focus on the rest of the world.”

As of 2025, Netflix’s service still covers over 190 countries and regions globally, excluding mainland China, North Korea, Syria, the Crimean region (and Russia after 2022).

However, Warner Bros. is one of the deepest participants in the Chinese film market. When a blockbuster is released, it is generally imported smoothly, often earning higher box office returns in China than in North America. Warner previously explored the Sino-US co-production model through the Meg series, and the immensely popular “Wizarding World of Harry Potter” at Universal Beijing Resort is based on IP authorized by Warner.

Therefore, it is likely that Warner, as an “old friend of the Chinese people,” will continue the importation of existing series without major issues, while potentially exploring IP derivative licensing more actively. However, after abandoning the mainland Chinese market, Netflix’s issue of “ideological output” may continue to raise domestic concern. Aggressive LGBTQ+ representation is often standard in Netflix original content. Furthermore, if Netflix includes too much “personal agenda” in future Warner films, it might lead to Warner’s golden brand also facing “cold shoulder” treatment in mainland China, repeating the three-year absence of the MCU’s Phase Four.

Here are some comments from Chinese audiences under a quick update from Daotong:

“There are so many cinematic fundamentalists in the comment section. The film industry’s slump wasn’t caused by Netflix; it’s a trend of the times. The key is that Hollywood studios are stuck in their ways and not innovating. Decline is inevitable. Maybe Netflix acquiring Warner will introduce new ideas and bring innovation to the film industry!”

“Now Disney, Netflix, Apple, and Sony are the four streaming giants dominating the market. With money, they should just focus on sequels and unexploited IPs. Films like World War Z, I Am Legend, Ender’s Game, and more superhero movies. Since it’s a multiverse, they can film cool, flashy movies like Iron Man and Spider-Man, or Joker and sexy Transformers. It’s pointless to hoard so much money without using it. They should create more value for the world. Amazon and Skydance need to step up their game; they have no presence.”

7. Why Did WBD Never Agree to the Oracle Prince’s Acquisition Offer?

If they were going to sell eventually, why did they reject the olive branch from Paramount/Skydance before?

Based on our previous in-depth observations, Paramount/Skydance made a very aggressive and sincere offer. They bid three times, raising the price from approximately $19 per share to $23.50, totaling nearly $60 billion. To facilitate the deal, Paramount even increased the proposed cash portion from 60% to 80% and promised a $2.1 billion “breakup fee” if regulators disapproved.

However, WBD’s current CEO, David Zaslav, consistently refused to agree. There were two core reasons: first, he did not want to retire or lose real power, and second, he hoped to force a higher price.

To outsiders, if the company were acquired by the Ellison family (Oracle), Paramount’s proposal for Zaslav to serve as “co-CEO” of the merged company was likely just a “figurehead title.” Zaslav did not want to surrender the reins yet. By leaking news to employees that “Apple, Amazon, and Netflix are also interested in mergers,” he attempted to create a competitive atmosphere, pressuring the Ellison family to further raise their offer.

Most importantly, he was not under the same urgent pressure to sell as his predecessor. Even if no one bought the company after he split it in two, he could still manage the valuable studio business while shedding the constantly hemorrhaging cable television business. These factors all served as his negotiating chips.

Image Source: Oracle Official Website

Ultimately, Netflix’s isolated offer of $82.7 billion for the studio business proves Zaslav won the gamble on price. However, the probability of Zaslav retaining his position in the new Netflix-controlled Warner is virtually zero. His role in this merger is more akin to a “cleaner,” tasked with clearing debt and shedding bad assets.

Netflix currently employs a highly stable co-CEO structure, with Ted Sarandos responsible for content and Hollywood relations, and Greg Peters overseeing technology and product. There was no space for Zaslav in the Paramount/Skydance structure, and there certainly will be none at Netflix.

According to Zaslav’s previous employment contract, if he resigns due to the company’s acquisition, a massive severance clause is triggered. The millions of shares of Restricted Stock Units (RSUs) and options he holds would typically vest immediately upon the completion of the merger. Media estimates suggest his total severance package could reach $150-$200 million. The continuously rising WBD stock price and the higher final acquisition price were partially what he secured for himself.

After stepping away from the Hollywood spotlight, Zaslav is predicted to potentially move into private equity, non-media CEO roles, or perhaps simply retire behind the scenes to a board position.

🌟 An Essential Post-Acquisition Question: The Hardware Imperative

The Content Has Scaled to $82.7 Billion. Has Your Hardware Kept Up?

Netflix’s acquisition of Warner Bros. Discovery is not merely a corporate reshuffle; it is a promise of cinematic quality. The consolidated library—encompassing HBO’s intricate sound design (Succession, The Last of Us) and Warner’s blockbuster scale (Dune, DC Universe)—represents the highest standard of modern media production, meticulously engineered with complex Dolby Atmos soundscapes.

This premium, high-stakes content demands a hardware foundation capable of delivering every detail of the director’s sonic vision to the home. This is where the AmpVortex-16060A flagship AVR steps in, becoming the essential decoder for the new Netflix Cinematic Universe.

AmpVortex-16060A: The Only Way to Hear the Full Story

The 16060A is built to resolve the intricacies of the most demanding audio tracks, ensuring you experience the content exactly as the $82.7 billion investment intended:

- Ultimate Immersive Audio:With native support for advanced Dolby Atmos layouts up to 1.6 or 10.4.6, the 16060A provides the raw processing power to place sound objects precisely in three-dimensional space, transforming a living room into a commercial cinema.

- Acoustic Perfection:The integrated LiveTune Room Correction system acoustically optimizes any listening space, guaranteeing that the dialogue from an HBO drama is crystal clear and the bass from a DC explosion is tightly controlled, free from room interference.

- Hi-Res Streaming & Integration:Beyond cinema, the 16060A is a top-tier audio hub, supporting 192kHz lossless music playback via AirPlay 2, Spotify Connect, and Qobuz Connect. For the modern luxury home, its KNX integration allows seamless, centralized control over the entire smart ecosystem.

The merger confirms that the future of home entertainment is premium and cinematic. Do not let outdated hardware create an audio bottleneck for this wealth of content. The time to upgrade your system to match the value of your new content library is now.

Embrace Reality, Upgrade Your Auditory and Visual World.

Visit www.ampvortex.com today to discover how the AmpVortex-16060A defines true value and excellence in the wake of the AI bubble and the Streaming Wars.

About Ampvortex:

Ampvortex is a pioneering audio technology company dedicated to developing innovative, high-performance professional audio solutions. Our focus is on multi-functional, high-quality amplifiers and AVR products that deliver unparalleled auditory and visual enjoyment. Ampvortex products integrate advanced streaming, multi-zone control, and smart home capabilities, ideal for home cinema, multi-room audio, and commercial installations. Learn more at www.ampvortex.com.